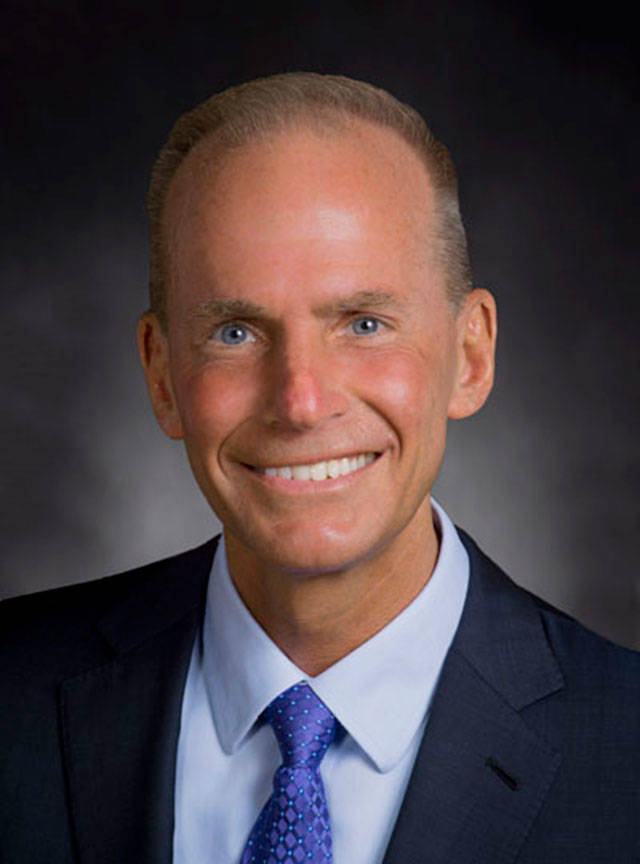

Boeing CEO Dennis Muilenburg praised the tax bill passed by Congress on Wednesday and about to be signed into law by President Donald Trump as a critical driver of business, economic growth and innovation for the United States and for Boeing.

“On behalf of all of our stakeholders, we applaud and thank Congress and the administration for their leadership in seizing this opportunity to unleash economic energy in the United States,” Muilenburg said in a news release. “It’s the single-most important thing we can do to drive innovation, support quality jobs and accelerate capital investment in our country.”

The simpler tax code and lower tax rate are closer to those enjoyed by Boeing’s global competition and will have a clear and direct benefit to Boeing, its employees and other stakeholders.

“For Boeing, the reforms enable us to better compete on the world stage and give us a stronger foundation for the investment in innovation, facilities and skills that will support our long-term growth,” Muilenburg said.

While Boeing is still studying all of the provisions of the new legislation, Muilenburg announced immediate commitments for an additional $300 million in investments that will move forward as a result of the new tax law:

• $100 million for corporate giving, with funds used to support demand for employee gift-match programs and for investments in Boeing’s focus areas for charitable giving: in education, in our communities, and for veterans and military personnel.

• $100 million for workforce development in the form of training, education, and other capabilities development to meet the scale needed for rapidly evolving technologies and expanding markets.

• $100 million for “workplace of the future” facilities and infrastructure enhancements for Boeing employees.

“Each of these investments benefits Boeing’s most important strength – our employees – and reflects the real-time impact and economic benefit of the reforms,” Muilenburg said.

The bill lowers the corporate tax rate to 21 percent from 35 percent starting Jan. 1.

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website https://www.kentreporter.com/submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.