Rep. Entenman proposes sales tax break for low- and middle-income families

Published 3:30 pm Wednesday, February 13, 2019

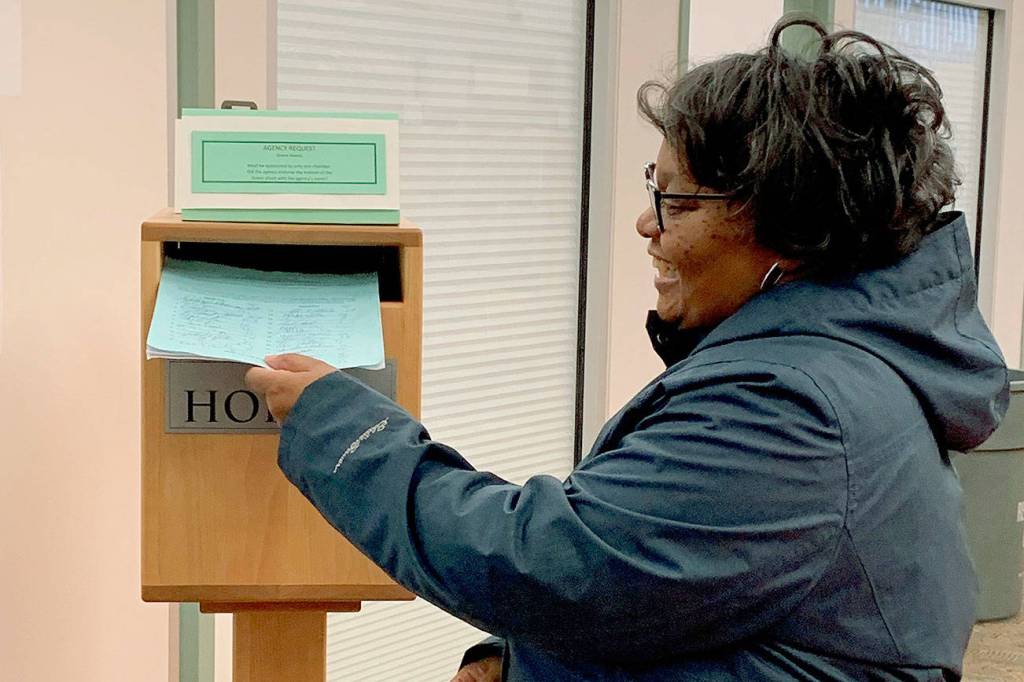

Rep. Debra Entenman, D-Kent, who represents the 47th Legislative District, has proposed a refund on state sales taxes for lower-income workers.

The bill to advance the Working Families Tax Credit aims to help families make ends meet while addressing the state’s inequitable tax code.

The Working Families Tax Credit (House Bill 1527) would put cash back in the pockets of low- and middle-income workers – providing an average annual income boost of $350. The maximum credit would be $970.

Entenman herself grew up with a single mother who was a teacher with three children, and they had a grandmother who also lived with them. “Having $350 extra dollars per year would have made a difference in our family,” she said.

The credit is based on the federal Earned Income Tax Credit (EITC), a highly successful anti-poverty program. More than 5,400 people in Auburn alone currently receive the EITC. Many more than that would benefit from the state tax credit, as its qualifications are more expansive than the federal program. Overall, the Working Families Tax Credit would reach close to 1 million households in Washington.

And Entenman’s proposal would also help rebalance Washington state’s upside-down tax code that is making it harder for low-wage workers to get ahead. Our state has the most inequitable tax code in the nation, where the lowest-income workers pay the highest share of their income in state and local taxes – about 18 percent of their income compared to 3 percent for the wealthiest 1 percent.

“Lawmakers have a unique opportunity to return money back to hardworking families and workers who are struggling under an economy that just isn’t working for them,” Entenman said.

A recent fact sheet published by the Working Families Tax Credit Coalition notes that the policy aims to make the state more livable and affordable for working people. The credit also drives economic growth, promotes better educational and health outcomes for kids and families, and promotes racial equity.

“The Working Families Tax Credit is one of the best investments our state can make in our workers and our economy,” Entenman said. “Families in Auburn, Kent, and throughout Washington need to be able to make ends meet. This proposal lets them keep more of what they earn and gives communities the boost they need to save a little more, spend more at the grocery store, or just get an extra tank of gas a month.”

The House hearing on this bill was on Feb. 7 and several people testified in support of it – noting how the Working Families Tax Credit would be good for moms, small businesses, domestic violence survivors, low-income students, and more. The Senate bill will be up for hearing soon.